Written by Eamonn McElroy, CPA, Atlanta

Published August 7, 2025

The One Big Beautiful Bill Act (“OBBBA”) was signed into law by President Trump on July 4, 2025. The act is the most consequential tax reform since the Tax Cuts & Jobs Act (“TCJA”) was signed into law in 2017. The OBBBA makes permanent many temporary tax provisions created by the TCJA, removes a few tax provisions, and creates some tax temporary provisions of its own. Please see below for details on tax provisions in the OBBBA that will commonly affect individuals, small-mid sized businesses, and real estate investors.

Individuals - Extenders

Lower individual tax bracket rates made permanent

Treatment prior to OBBBA:

Lower individual tax bracket rates enacted by the TCJA were effective for tax years 2018-2025. These lower tax rates were set to expire with the 2025 tax year, and the higher pre-2018 individual tax rates would have been effective for the 2026 tax year and forward.

Treatment after OBBBA:

The lower individual tax rates enacted by the TCJA are made permanent. The OBBBA also provides an additional year of inflation adjustment for certain tax brackets.

Standard deduction and exemption treatment made permanent; enhanced standard deductions for 2025 tax year

Treatment prior to OBBBA:

The TCJA substantially increased standard deductions and eliminated personal exemptions, effective for tax years 2018-2025. These changes were set to expire with the 2025 tax year.

Treatment after OBBBA:

These changes are made permanent. Also, the 2025 tax year standard deduction amounts are given an additional inflation increase of 5%.

Author’s observation:

For most taxpayers, these changes are a net positive even when considering the personal exemption elimination. Taxpayers with large families (three or more dependent children) are primary examples of taxpayers for whom this change is a net negative.

Increased child & dependent tax credits made permanent and enhanced

Treatment prior to OBBBA:

The TCJA temporarily increased the child tax credit from $1,000 per child to $2,000 per child for tax years 2018-2025. The phaseout thresholds for the credit were also substantially increased. The child tax credit and phaseout thresholds were scheduled to decrease substantially for the 2026 tax year.

For tax years 2018-2025, the TCJA also created a temporary $500 tax credit for other dependents who didn’t qualify for the child tax credit. This credit was scheduled to expire and would have no longer been available starting with the 2026 tax year.

These credits were not adjusted for inflation.

Treatment after OBBBA:

The child tax credit is increased to $2,200 per child and made permanent. The increased phaseout thresholds were made permanent. The amount of the child tax credit will now be indexed for inflation after the 2025 tax year.

The $500 tax credit for other dependents who don’t qualify for the child tax credit is also made permanent.

Increased estate & gift tax exemptions made permanent and enhanced

Treatment prior to OBBBA:

The TCJA substantially increased the lifetime estate and gift tax exemption temporarily for tax years 2018-2025. Roughly speaking, the amount of lifetime estate and gift tax exemption was doubled under the TCJA. This provision was set to expire and the lower exemption amounts would have been in effect starting with the 2026 tax year.

The lifetime estate and gift tax exemption was indexed for inflation and adjusted annually.

Treatment after OBBBA:

The increased lifetime estate and gift tax exemptions are made permanent. For the 2026 tax year, the lifetime estate and gift tax exemption will be increased to $15 million ($30 million for joint filers). These amounts will be indexed for inflation and adjusted annually thereafter.

Cap on personal residence mortgage interest made permanent and mortgage insurance premiums made deductible

Treatment prior to OBBBA:

The TCJA temporarily limited the deduction of personal residence mortgage interest to $750,000 of mortgage principal for tax years 2018-2025. This provision was set to expire and the former mortgage principal limit of $1 million would have applied for tax years 2026 and forward.

Mortgage insurance premiums (“MIP” or “PMI”) paid for a residence are not deductible.

Treatment after OBBBA:

The $750,000 personal residence mortgage principal cap is made permanent.

Mortgage insurance premiums paid for a residence are deductible, subject to an income phaseout.

Author’s observation:

It would have been nice to see the $750,000 principal cap indexed for inflation. Unfortunately, it wasn’t pre-OBBBA and still isn’t.

State and local tax deduction limit extended and temporarily enhanced

Treatment prior to OBBBA:

For taxpayers who itemize, the state and local tax deduction is temporarily limited to $10,000 for tax years 2018-2025 under the TCJA. This limitation was set to expire and state and local taxes would have been deductible in full by itemizers starting with tax year 2026.

Treatment after OBBBA:

The OBBBA extends this limitation, and temporarily increases the deductible amount to $40,000 for the 2025 tax year, with 1% annual increases for each of the 2026-2029 tax years. Starting with the 2030 tax year, the limit on deductible state and local taxes reverts to $10,000.

The OBBBA also introduces a phaseout on the increased limitation. The limitation is decreased by 30% of the amount a taxpayer's modified adjusted gross income exceeds the threshold amount, however the limitation is not reduced below $10,000. The threshold amount is $500,000 for the 2025 tax year, with 1% annual increases for each of the 2026-2029 tax years.

Author’s observation:

High income taxpayers (those with more than $600,000 modified adjusted gross income) are unlikely to benefit from the increased limitation due to the steep phaseout.

For certain business owners, a passthrough-entity tax election (PTET election) remains compelling and a valid strategy if the individual business owner takes the standard deduction or itemizes and is otherwise subject to the state and local tax limitation.

Tax treatment of student loan discharged modified and extended

Treatment prior to OBBBA:

Qualifying student loans that were discharged during the 2021-2025 calendar years were not included in federal taxable income. This temporary provision was set to expire and would no longer be available starting with the 2026 calendar year.

Treatment after OBBBA:

This provision was made permanent for calendar years 2026 and forward, but only for student loans discharged due to death or total & permanent disability.

Also, the taxpayer is required to provide a valid social security number to receive this tax benefit.

Author’s observation:

Note that this provision does not eliminate or modify the Public Service Loan Forgiveness (PSLF) program.

Individuals - New Provisions

Limit on benefit of itemized deductions for high earners

Treatment prior to OBBBA:

There wasn't a limit on the tax benefit from itemized deductions for tax years 2018-2025 under the TCJA.

Treatment after OBBBA:

Effective for tax years 2026 and forward, for taxpayers who are in the 37% individual income tax bracket, the benefit from itemized deductions will be reduced by 2/37 of the lesser of: (1) their total itemized deductions, or (2) the amount of their taxable income in the 37% bracket.

Author’s observation:

This isn't a phaseout and the effects shouldn't be significant for most high-earning taxpayers. In a nutshell, it effectively provides a 35% tax deduction for itemized deductions rather than a 37% deduction.

Limit on benefit of charitable deductions for itemizers

Treatment prior to OBBBA:

This limit didn't exist prior to the OBBBA.

Treatment after OBBBA:

For tax years 2026 and forward, only charitable contributions which exceed 0.5% of the taxpayer's "contribution base" are deductible as itemized deductions. The contribution base is defined as modified adjusted gross income.

Author’s observation:

To provide an example, consider a taxpayer who has $1,000,000 of modified adjusted gross income and who contributes $100,000 to charities during the year. 0.5% of the taxpayer's contribution base of $1,000,000 is $5,000. Therefore, only $95,000 of the charitable contributions are deductible on the taxpayer's tax return.

This change makes donor advised funds (DAFs) and "bunching" multiple years of charitable contributions even more compelling now for taxpayers who itemize and regularly give large amounts to charity.

Important -- 2025 tax year only: taxpayers who itemize and make large charitable contributions each year should strongly consider utilizing a donor advised fund to bunch contributions before end of year 2025, as the value of a 2025 tax year charitable contribution may be stronger than a 2026 tax year charitable contribution considering this new change. This is especially true for high earners who may be subject to the "limit on benefit of itemized deductions" previously mentioned. Continuing with our previous example of a taxpayer with $1,000,000 income, a $100,000 charitable contribution could be worth a $37,000 tax reduction on the 2025 tax return, but only $33,250 on the 2026 tax return after applying both the new limitation on charitable contributions and the limitation on benefits from itemized deductions.

Cash charitable contribution deduction for those who take the standard deduction

Treatment prior to OBBBA:

Cash charitable contributions are deductible only if the taxpayer itemizes, not if the taxpayer takes the standard deduction.

Treatment after OBBBA:

For tax years 2026 and forward, taxpayers will be allowed to deduct up to $1,000 ($2,000 for joint filers) for cash charitable contributions made during the year if the taxpayer takes the standard deduction and doesn't itemize.

Author’s observation:

Note that this change is for 2026 and forward. It doesn't apply to cash contributions made during the remainder of 2025.

Charitable contributions for this purpose mean contributions to a tax-exempt organization or foundation. It generally doesn't include gift platforms like GoFundMe, etc.

Modification on deductibility of wagering (gambling) losses

Treatment prior to OBBBA:

Losses from wagers are limited to winnings from gambling wagers if the taxpayer itemizes.

Treatment after OBBBA:

Losses from wagers are first limited to 90% of such losses, and second to the amount winnings, if the taxpayer itemizes.

Author’s observation:

To give some examples:

A taxpayer that itemizes has $10,000 winnings during the year and $5,000 losses. The taxpayer's losses are first limited to $4,500 (90%). As the reduced losses don't exceed the winnings, the two are netted and the taxpayer has $5,500 of taxable income from gambling for the year.

A taxpayer that itemizes has $10,000 winnings during the year and $15,000 losses. The taxpayer's losses are first limited to $13,500 (90%). As the reduced losses exceed the winnings, the reduced losses are limited to the winnings amount ($10,000) and the taxpayer has -0- taxable income from gambling for the year.

Temporary additional deduction for seniors

Treatment prior to OBBBA:

Seniors did not receive this additional exemption/deduction.

Treatment after OBBBA:

For tax years 2025-2028, taxpayers age 65 and up receive an additional $6,000 deduction ($12,000 in the case of joint filers if both spouses qualify). This deduction begins to phase out for taxpayers with modified adjusted gross income of $75,000 ($150,000 for joint filers). The deduction phases out by 6% for each dollar above the applicable phase-out threshold.

A valid social security number is required to receive the additional deduction for seniors.

Author’s observation:

Note this additional deduction is in addition to the additional standard deduction for taxpayers age 65 and up, and taxpayers will receive it regardless of whether they itemize or take the standard deduction.

Temporary deduction for those who receive tip income

Treatment prior to OBBBA:

Tip income is taxable in full; there isn't a deduction for tip income.

Treatment after OBBBA:

For tax years 2025-2028, those who receive qualified tips can claim a deduction for those qualified tips of up to $25,000. This deduction begins to phase out for taxpayers with modified adjusted gross income of $150,000 ($300,000 for joint filers).

Qualified tips are defined as cash tips received by an individual in an occupation which customarily and regularly received tips on or before December 31, 2024. The OBBBA instructs the Secretary of the Treasury to issue further guidance on what specific occupations qualify within 90 days of the OBBBA being passed into law.

Author’s observation:

This deduction is not available to married taxpayers who elect to file separately. Taxpayers will receive this deduction regardless of whether they itemize or take the standard deduction.

Taxpayers who receive tips should scrutinize their W-2, 1099-NEC or 1099-K to make sure tip income was correctly reported for the 2025-2028 tax years, and work with the employer/issuer if any corrections need to be made.

Temporary deduction for those who receive overtime pay

Treatment prior to OBBBA:

Overtime pay is taxable in full; there isn't a deduction for overtime pay.

Treatment after OBBBA:

For tax years 2025-2028, those who receive qualified overtime pay can claim a deduction for that qualified overtime pay of up to $12,500 ($25,000 for joint filers). This deduction begins to phase out for taxpayers with modified adjusted gross income of $150,000 ($300,000 for joint filers).

Qualified overtime pay is defined as pay required under Section 7 of the Fair Labor Standards Act of 1938 that is in excess of the employee's regular rate at which such individual is employed.

Author’s observation:

This deduction is not available to married taxpayers who elect to file separately. Taxpayers will receive this deduction regardless of whether they itemize or take the standard deduction.

Taxpayers who receive overtime pay should scrutinize their W-2, 1099-NEC or 1099-K to make sure overtime pay was correctly reported for the 2025-2028 tax years, and work with the employer/issuer if any corrections need to be made.

Temporary deduction on personal vehicle loan interest

Treatment prior to OBBBA:

Interest on personal vehicle loans was not deductible.

Treatment after OBBBA:

For tax years 2025-2028, taxpayers may deduct qualified passenger vehicle loan interest of up to $10,000 each year. This deduction begins to phase out for taxpayers with modified adjusted gross income of $100,000 ($200,000 for joint filers). The deduction is completely phased out for taxpayers with modified adjusted gross income of $150,000 ($250,000 for joint filers).

Qualified passenger vehicle loan interest is interest paid or accrued during the taxable year on indebtedness incurred by the taxpayer after December 31, 2024, for the purchase of, and that is secured by a first lien on, an Applicable Passenger Vehicle for personal use.

An Applicable Passenger Vehicle means any vehicle:

- The original use of which commences with the taxpayer (used vehicles do not qualify),

- Which is manufactured primarily for use on public streets, roads, and highways (does not include a vehicle operated exclusively on a rail or rails),

- Which has at least 2 wheels,

- Which is a car, minivan, van, sport utility vehicle, pickup truck, or motorcycle,

- Which is treated as a motor vehicle for purposes of Title II of the Clean Air Act,

- Which has a Gross Vehicle Weight Rating (“GVWR”) of less than 14,000 pounds,

- Which has a Vehicle Identification Number (“VIN”), and

- Which underwent final assembly within the United States.

The VIN Decoder website for the National Highway Traffic Safety Administration provides plant of manufacture information. Taxpayers can follow the instructions on that website to determine if the vehicle’s plant of manufacture is located in the United States.

Qualified passenger vehicle loan interest doesn’t include amounts paid or accrued on the following:

- A loan to finance fleet sales,

- A loan incurred for the purchase of a commercial vehicle that is not used for personal purposes,

- Any lease financing,

- A loan to finance the purchase of a vehicle with a salvage title, or

- A loan to finance the purchase of a vehicle intended to be used for scrap or parts.

Other important information:

- Taxpayers don’t need to itemize to receive this deduction.

- Businesses that receive $600 or more in vehicle interest payments from a taxpayer during the year will be required to issue an information return (likely in the Form 1098 series) by the January 31st following the close of each tax year to assist taxpayers with claiming this new deduction.

- If a qualifying vehicle loan is later refinanced, interest paid on the refinanced amount is generally still eligible for the deduction.

Author’s observation:

Consider timing purchases if a new vehicle is needed.

This tax deduction doesn’t supersede common sense personal finance analysis. e.g. If you can afford to pay cash, don’t carry an 8% note just for the tax deduction. If the dealer gives you a good deal -- i.e. 3% or less interest financing -- the tax and personal finance angles are lined up and it may make a lot of sense to finance.

Creation of Trump Accounts

Treatment prior to OBBBA:

Trump accounts did not exist prior to the OBBBA.

Treatment after OBBBA:

The OBBBA creates a new type of account, the Trump Account. A Trump Account is a Traditional IRA account that is established for the benefit of an individual that has not yet reached age 18 as of the year in which the Trump Account is created, and such account must be designated at the time of creation as a Trump Account. The account beneficiary must be have a valid social security number to open a Trump Account.

The facts about contributions:

- No contributions will be accepted to a Trump Account until 12 months after the enactment of the OBBBA. In other words, no contributions to a Trump Account will be accepted before July 4, 2026.

- For years before the calendar year in which the account beneficiary reaches age 18, contributions will be limited to $5,000 per calendar year in the aggregate. Starting with the 2028 tax year, the $5,000 limit will be indexed for inflation.

- Anyone can contribute to a Trump Account, including parents, grandparents, aunts/uncles, etc. Contributions made by individuals aren't deductible.

- An employer can contribute up to $2,500 per year to a Trump Account, however employer contributions count toward the $5,000 aggregate annual limit. Starting with the 2028 tax year, the $2,500 employer limit will be indexed for inflation. Contributions made by an employer are deductible by the employer.

- For children born in the 2025-2028 calendar years, the Treasury will contribute $1,000 to the child's Trump Account. The child must be a US citizen to receive this contribution, and this contribution doesn't count toward the $5,000 aggregate annual limit.

- Up until the calendar year in which the account beneficiary reaches age 18, certain government entities and tax-exempt organizations (charities) are authorized to make contributions to Trump Accounts, and these contributions don't count toward the $5,000 aggregate annual limit. These entities may make contributions based on an "eligible class" which they define. Examples of an eligible class may include children born during a certain time period and/or born in a certain geographic area.

- For years before the calendar year in which the account beneficiary reaches age 18, the account beneficiary doesn't need earned income to be eligible for a Trump Account contribution.

In the year that the account beneficiary reaches age 18, the account becomes just like any other Traditional IRA for purposes of contributions, distributions, conversions, and allowable investments.

The facts about distributions:

- As contributions made by individuals (parents, grandparents, aunts/uncles, etc) are not deductible, a portion of each future distribution allocable to these individual contributions is non-taxable (a return of capital). This will require parents and eventually the account beneficiary to maintain and track these cumulative individual contributions from year to year.

- In general, distributions will not be allowed until the calendar year in which the account beneficiary reaches age 18. At that point, distributions are taxed as ordinary income. The distribution may also be subject to the 10% early withdraw penalty unless the distribution is made after age 59 ½ or satisfies an IRA penalty exception.

Until the calendar year in which the beneficiary reaches age 18, all account funds must be invested in a mutual fund or exchange traded fund which:

- Tracks the S&P 500 index or any other index which is comprised of equity investments in primarily United States companies and for which regulated futures contracts are traded on a qualified board or exchange (industry/sector specific funds are not allowed, but funds based on market capitalization are okay),

- Doesn't use leverage,

- Doesn't have annual fees or expenses more than 0.1% of the balance of the investment in the fund, and

- Meets other criteria as the Secretary of the Treasury deems appropriate.

Author’s observation:

Tracking basis in Trump Accounts (contributions made by individuals -- parents, grandparents, aunts/uncles, etc) will be paramount.

For children born during 2025-2028, it is a no-brainer to open a Trump Account and receive the initial $1,000 seed capital from the Treasury. It is also a no-brainer to open a Trump account if your child is a member of a class eligible for a contribution by a government entity or tax-exempt org (charity), or if your employer is making contributions for employee's children. Otherwise, it seems unlikely that a Trump Account is the best investment vehicle for minor children given the alternatives, particularly a 529 account, if one has to choose.

There is current uncertainty regarding whether self-employed individuals, and whether businesses with owner(s) as the only employee(s) will qualify to make a deductible employer contribution. If these businesses are eligible, Trump Accounts for minor children become pretty compelling for those individual business owners.

529 plans - Qualifying K-12 costs expanded and annual cap increased

Treatment prior to OBBBA:

The only K-12 related cost that qualifies for a tax-free 529 plan distribution is tuition for enrollment or attendance at a public, private or religious K-12 school. The amount of tax-free distributions allowable for K-12 related costs is capped at $10,000 per beneficiary per year.

Treatment after OBBBA:

The OBBBA expands qualifying 529 plan distributions to include the following costs related to K-12 education:

- Curriculum and curricular materials,

- Books or other instructional materials,

- Tuition for tutoring or educational classes outside of the home, including at a tutoring facility, but only if the instructor or tutor is not related to the student and meets one of the following requirements:

- is licensed as a teacher in any state,

- has taught at an eligible educational institution, or

- is a subject matter expert in the relevant subject.

- Fees for a national standardized norm-referenced achievement test, an advanced placement examination, or examinations related to college or university admission,

- Fees for dual enrollment in an institution of higher education, and

- Educational therapies for students with disabilities provided by a licensed or accredited practitioner or provider, including occupational, behavioral, physical, and speech-language therapies.

The changes above apply for distributions made after July 4, 2025.

Further, the amount of tax-free distributions allowable for K-12 related costs is increased to $20,000 per beneficiary per year. This particular change is for tax years starting with the 2026 tax year.

Author’s observation:

Note the increase in total annual qualifying K-12 costs from $10,000 to $20,000 is effective starting 2026, not 2025.

Regarding the last point above (educational therapies for students with disabilities...), if a taxpayer has a child with a qualifying disability, an ABLE account will likely be a better option for the child than a 529 account.

529 plans - Qualifying postsecondary credentialing costs added

Treatment prior to OBBBA:

Postsecondary credentialing costs aren't qualifying costs for 529 plan purposes.

Treatment after OBBBA:

The OBBBA expands qualifying 529 plan distributions to include the following costs related to postsecondary credentialing:

- Tuition, fees, books, supplies, and equipment required for the enrollment or attendance in a recognized postsecondary credential program,

- Fees for testing if such testing is required to obtain or maintain a recognized postsecondary credential, and

- Fees for continuing education if such education is required to maintain a recognized postsecondary credential.

This change applies for distributions made after July 4, 2025.

Author’s observation:

The list of recognized postsecondary credentials is broad. Examples include trade certifications like HVAC, plumbing, CDL, and professional licensing exams such as the bar exam or CPA exam.

Most often, these costs will be best deducted by the employer as a business expense if possible. If that is not an option, using a 529 plan to fund these costs appears advantageous if they are significant.

Businesses - Extenders

Deduction for qualified business income made permanent and enhanced

Treatment prior to OBBBA:

The TCJA created a temporary deduction equal to 20% of qualified business income from certain types of businesses for the 2018-2025 tax years. This provision was set to expire starting with the 2026 tax year.

For higher income taxpayers, there is a "phase-in" that requires the business to pay wages and/or have invested in fixed assets in order to claim the deduction. For the 2024 tax year, the phase-in window starts at $191,950 of taxable income ($383,900 for joint filers) and ends at $241,950 ($483,900 for joint filers).

Treatment after OBBBA:

The 20% qualified business income deduction enacted by the TCJA is made permanent.

Phase-in ranges are increased from $50,000 ($100,000 for joint filers) to $75,000 ($150,000 for joint filers).

Additionally, starting with the 2026 tax year, taxpayers who materially participate in one or more businesses will receive a $400 minimum qualified business income deduction as long as the aggregate qualified businesses income from all businesses in which the taxpayer materially participates is at least $1,000. Starting with the 2027 tax year, the $400 minimum deduction and $1,000 testing threshold will be indexed for inflation.

100% bonus depreciation made permanent

Treatment prior to OBBBA:

For federal income tax purposes, taxpayers are able to recover a certain percentage of the cost of some classes of business assets in the first year. The TCJA boosted that percentage to 100% for the 2018-2022 tax years, and the percentage was scheduled to step-down by 20% each year thereafter until it was phased out by the end of the 2026 tax year (e.g. 80% for 2023 tax year, 60% for 2024 tax year, etc).

Treatment after OBBBA:

100% bonus depreciation is made permanent for certain classes of assets acquired and put into service on or after January 20, 2025. Further, if a binding written contract to acquire property is entered into prior to January 20, 2025, the property is treated as being acquired prior to January 20, 2025 regardless of when closing occurs.

Author’s observation:

Taxpayers need to be particularly careful about the last paragraph (when property was acquired and binding contracts). The language in the OBBBA is clear regarding this matter, and it's unlikely any authoritative guidance from the IRS will contradict the language in the statute. For eligible property acquired prior to January 20, 2025, and put into service on or after January 20, 2025, the former tax law applies and the property would be eligible for 40% bonus depreciation, not 100%.

Gain deferral via qualified opportunity zones made permanent and refined

Treatment prior to OBBBA:

Created by the TJCA, qualified opportunity zones allow individuals and businesses to defer capital gain by investing in low-income census tracts. This provision was set to expire on December 31, 2026.

Treatment after OBBBA:

Qualified opportunity zones are made permanent. Qualifying low-income census tracts will be re-determined in the 90-day period beginning on July 1, 2026 and every 10 years thereafter. During the 90-day determination periods, each state will create an updated list of qualifying low-income census tracts in its jurisdiction and provide that list to the Secretary of the Treasury by the end of the 90-day period for certification.

Prior to the OBBBA, a small number of census tracts (up to 5% per state) could be labeled as qualifying opportunity zones if they were contiguous with low-income census tracts, even if they were not low-income census tracts. The OBBBA removes this provision, and limits eligible census tracts to those that are truly low-income.

For investments in qualified opportunity zones on or before December 31, 2026, the rules in place prior to the OBBBA apply regarding gain deferral. In other words, gain deferral on an investment made in a qualified opportunity fund on or before December 31, 2026 will be deferred until the earlier of (1) the date the qualified opportunity fund is sold or exchanged, or (2) December 31, 2026.

For investments in qualified opportunity zones on or after January 1, 2027:

- Capital gain is deferred until the earlier of (1) the date the qualified opportunity fund is sold or exchanged, or (2) the date which is 5 years after the date the investment in the qualified opportunity fund was made.

- If the qualified opportunity fund is held the full 5 years, 10% of the gain deferral will be excluded from tax. In the case of a qualified rural opportunity fund held the full 5 years, 30% of the gain deferral will be excluded from tax.

- If the qualified opportunity fund is held at least 10 years (and less than 30 years), all additional gain beyond the initial gain deferral is excluded from tax.

- If the qualified opportunity fund is held more than 30 years, special rules apply and any appreciation beyond the 30th year won't be excluded from tax when the qualified opportunity fund is sold.

Author’s observation:

New investments in qualified opportunity zones prior to December 31, 2026 appear to be non-compelling in most cases due to the compressed gain deferral timeline. Starting on January 1, 2027, qualified opportunity zones become compelling as a tax planning option.

An example timeline for an investment on or after January 1, 2027:

- Taxpayer realizes $1,000,000 of capital gain during 2027, and timely invests the $1,000,000 capital gain into a qualified opportunity fund.

- The $1,000,000 capital gain is deferred and taxpayer isn't taxed on this capital gain on his 2027 tax returns.

- In 2032, after holding for 5 years, the deferral period ends and the taxpayer realizes $1,000,000 of capital gain and receives a 10% basis adjustment. Taxpayer recognizes and pays tax on $900,000 of capital gain on his 2032 tax return.

- In 2039, after 12 years of holding the qualified opportunity fund, taxpayer liquidates his investment for $2,000,000. As the taxpayer held the fund for at least 10 years, the additional $1,000,000 gain (beyond his original $1,000,000 investment), is tax free.

Some states may not conform to the tax treatment of qualified opportunity funds. For states that do not conform, favorable tax benefits and deferrals may not be granted at the state level.

Tax is just one consideration when evaluating an investment. The economics should also make sense and the ROI should be compelling given the alternatives.

Businesses - New Provisions

Full expensing of research & experimental expenditures

Treatment prior to OBBBA:

Research & experimental ("R&E") expenditures are required to be capitalized and amortized. Domestic R&E expenditures are amortized over 5 years, and foreign R&E expenditures are amortized over 15 years.

Treatment after OBBBA:

Starting with the 2025 tax year, domestic R&E expenditures can be fully expensed. Foreign R&E expenditures must still be capitalized and amortized over 15 years.

Additionally, "small businesses" are allowed to amend 2022-2024 tax years to elect to retroactively expense any domestic R&E expenditures for those years. Small businesses are defined for this purpose as businesses having average gross receipts of $31 million or less over the past three years. All businesses, including those who aren't small businesses, can elect to fully expense any remaining tax basis in domestic R&E expenditures made during the 2022-2024 tax years over a one to two year period.

Qualified small business stock gain exclusion enhanced and expanded

Treatment prior to OBBBA:

Qualified small business stock ("QSBS") may be eligible for a partial exclusion of gain on the sale of stock held for more than five years. For stock acquired after September 27, 2010, the exclusion is 100%; for stock acquired in earlier periods, the exclusion is 50% or 75%, depending on the acquisition date.

QSBS is stock in a United States C Corporation that must have gross assets of $50 million or less at the time the stock is issued, is actively involved in certain qualifying businesses, and is not publicly traded at the time the stock is acquired by the individual.

Qualifying businesses include, but are not limited to, manufacturing, retail, technology and wholesaling. Business that don't qualify include, but are not limited to personal services, banking, insurance, financing, leasing, investing, farming, mining, or operating a hotel/motel or restaurant.

The amount of QSBS gain that can be excluded is limited to the greater of (1) $10 million, or (2) 10 times the adjusted basis of the stock, per shareholder per company.

Treatment after OBBBA:

The OBBBA modifies the QSBS exclusion to provide a tiered gain exclusion based on the years the taxpayer holds the QSBS:

- 50% exclusion if held for three years,

- 75% exclusion if held for four years, and

- 100% exclusion if held for five or more years.

The act also increases eligibility for the exclusion by increasing the limit on the corporation’s aggregate gross assets at the time of stock issuance to a $75 million from $50 million. This new limit will be indexed for inflation starting with the 2027 tax year.

The amount of QSBS gain that can be excluded is increased. The gain exclusion is now limited to the greater of (1) $15 million, or (2) 10 times the adjusted basis of the stock, per shareholder per company. The $15 million dollar amount will be indexed for inflation starting with the 2027 tax year.

The changes above apply to QSBS acquired after July 4, 2025.

Thresholds for 1099 reporting increased

Treatment prior to OBBBA:

Businesses are required to report certain cash, check and EFT/ACH payments for compensation, services, rents and interest to the IRS each January by filing a Form 1099 if the amount of reportable payments during the tax year exceeds $600 in total.

Treatment after OBBBA:

The reporting threshold is increased to $2,000 and will be indexed for inflation starting with the 2027 calendar year.

The change above applies to payments made after December 31, 2025.

Author’s observation:

The existing rules and threshold ($600) applies to payments made during 2025 and 1099s filed in January 2026.

Other Changes

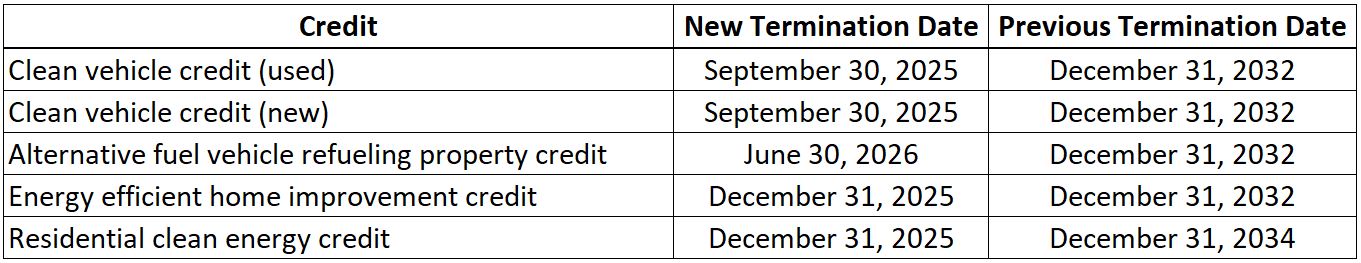

Termination of certain alternative energy credits

The following tax credits will now expire earlier than expected:

Author’s observation:

Taxpayers who are interested in these credits should move quickly to take advantage before they expire. Confirm with your tax advisor specific deadlines, purchase qualification requirements, and income phaseout thresholds.

Copyright © Eamonn McElroy CPA, LLC.

Disclaimer: Tax law, regulation and procedure are constantly changing. Eamonn McElroy CPA, LLC has provided this article as general information only and is under no obligation to update the article for future changes, including but not limited to changes in tax law or procedure. The information contained in the article is not tax, investment or legal advice, nor should it be construed as tax, investment or legal advice. You should consult with your advisors to determine how the information in this article affects you and what actions you may take and should take.