Written by Eamonn McElroy, CPA, Atlanta

Originally published November 29, 2021; Last updated May 18, 2022

Background

The CARES Act of 2020 contains a provision that allowed many individuals with self-employment income during the 2020 tax year to elect to defer part of that self-employment tax over two years. The first half of the deferral is due on or before December 31, 2021. The second half of the deferral is due on or before December 31, 2022. While the IRS previously indicated that vouchers with payment instructions would be mailed to those individuals who will need to make these deferral payments, many individuals who paper-filed their 2020 returns have not received vouchers as their 2020 returns remain unprocessed by the IRS many months after being mailed.

Fortunately, there is an online solution both for individuals who don't want to mail a check and for individuals who have not received vouchers. That solution is IRS Direct Pay, and in this article we'll detail how you can use this platform to submit your deferral payments quickly and conveniently at no cost to you.

How to get started and pay your first or second deferral payment with IRS Direct Pay

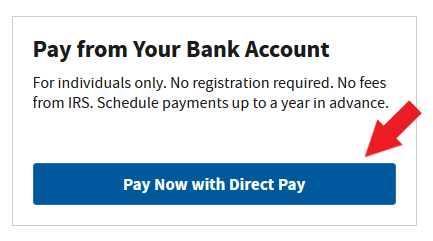

Navigate to https://www.irs.gov/payments and click “Pay Now with Direct Pay” under “Pay from Your Bank Account”.

You have been taken to a new screen. On this new screen, click “Make a Payment”.

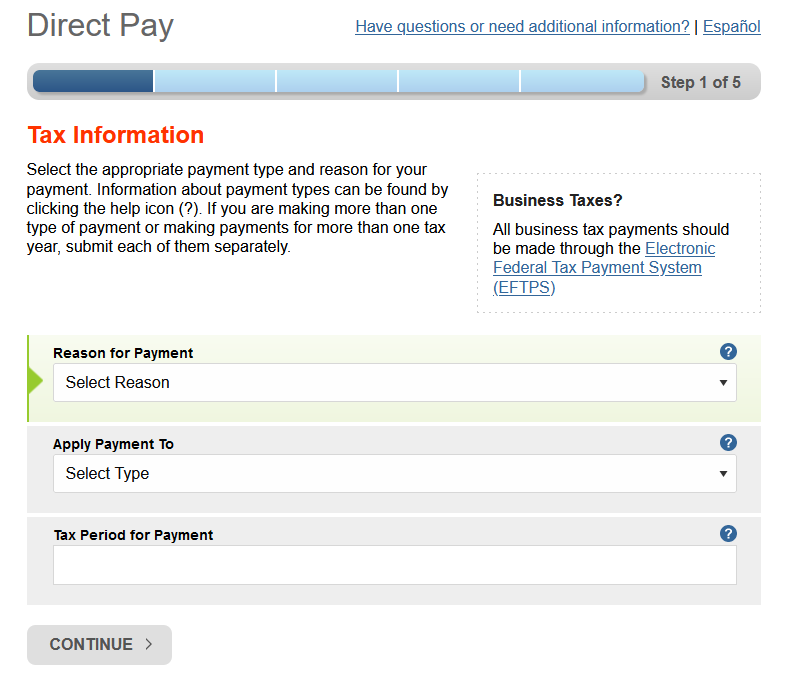

You have been taken to a new screen that looks like this:

Step 1 (Tax Information):

On this new screen, select:

- “Balance Due” under “Reason for Payment”,

- “Income Tax - Form 1040” under “Apply Payment To”, and

- “2020” under “Tax Period for Payment”.

Important: Both the deferral payment due December 31, 2021 and the deferral payment due December 31, 2022 should take care to select ”2020” as the tax period to apply the payment to, as that is the tax year to which the deferred tax relates.

After populating the three drop down boxes and carefully reviewing, click “Continue”.

Step 2 (Verify Identity):

You will be taken a new screen. On this new screen, you will enter information from one of your most recently filed tax returns to verify your identity. For this step, you will need a copy of the applicable year’s as-filed tax return (IRS Form 1040). Proceed to fill in the required information for the tax year you have chosen.

Important: If you paper filed your most recent tax return and it has not yet been processed by the IRS, you will NOT be able to use that tax year to verify your identity. Please choose the next most recent tax year available to you that has been processed by the IRS for this verification step.

Click “Continue” after you have completed all required fields.

Step 3 (Your Payment Information):

Proceed to enter in the amount you need to pay for this particular deferral.

Choose the date you would like to schedule the payment to be made. Please take into consideration and double check the due date of this payment, and schedule the payment no later than the due date.

Enter in your account information and the email address at which you’d like to receive a confirmation email.

Important: Many financial institutions will not allow a direct debit or an electronic funds transfer from a savings account and will reject the transaction. For this reason, it is generally advisable to use a checking account instead of a savings account.

Click “Continue” after you have reviewed your entries.

Step 4 (Review & Sign):

Carefully review all information on this page. Edit if necessary. Otherwise, enter the requested information to electronically sign for the payment submission and click “Submit”.

Step 5 (Confirmation):

Print this confirmation page (or save as a PDF) and retain in your tax records. If a tax professional or third party prepares your tax returns, give them this confirmation page along with your other source documents.

Click “Sign Out” at the top of the screen near your name. Close the browser tab. You’re done!

Copyright © Eamonn McElroy CPA, LLC.

Disclaimer: Tax law, regulation and procedure are constantly changing. Eamonn McElroy CPA, LLC has provided this article as general information only and is under no obligation to update the article for future changes, including but not limited to changes in tax law or procedure. The information contained in the article is not tax, investment or legal advice, nor should it be construed as tax, investment or legal advice. You should consult with your advisors to determine how the information in this article affects you and what actions you may take and should take.